So what even is Plasma?

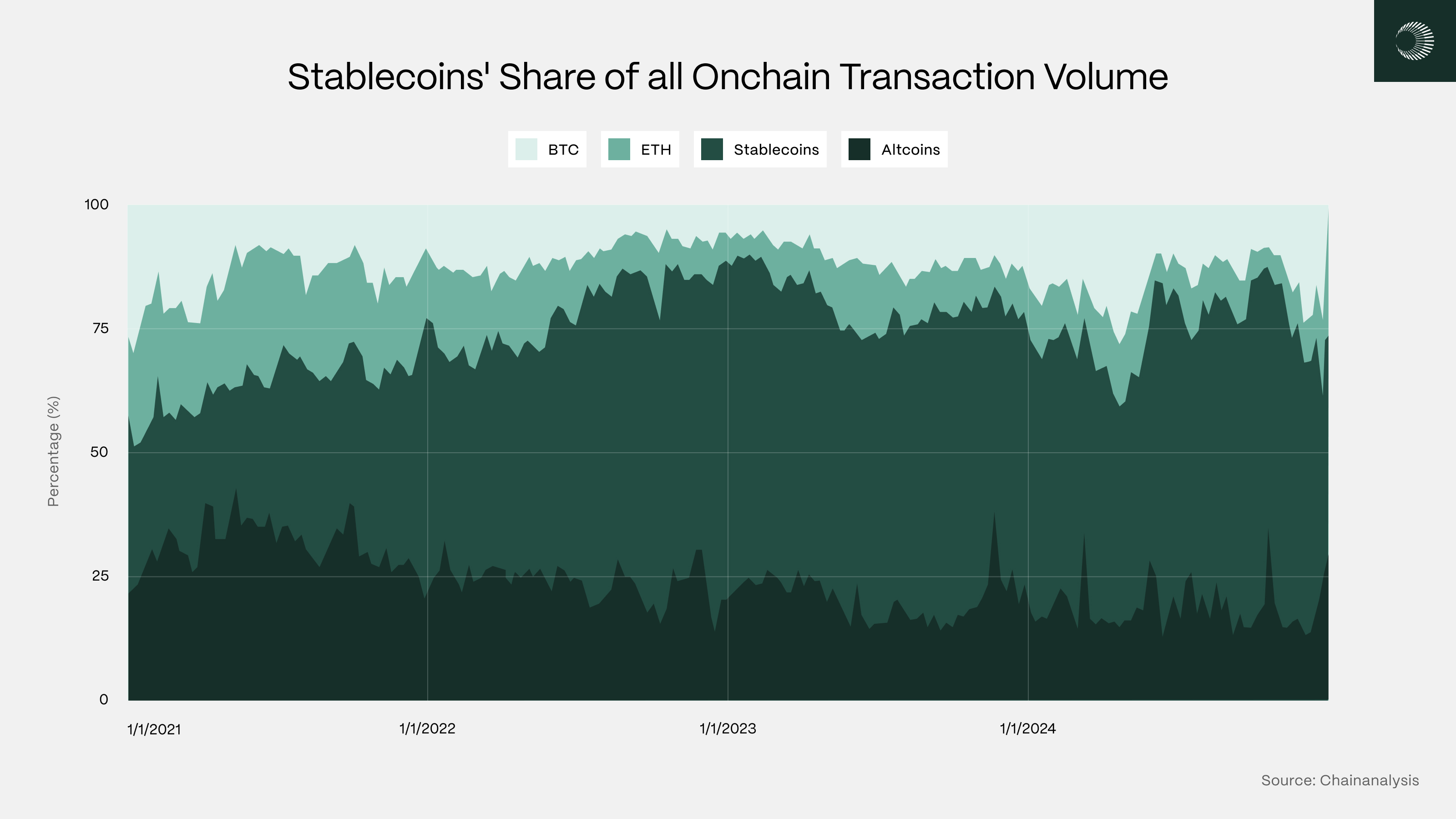

Plasma is a Layer 1 blockchain built with a focus on stablecoin transactions. The main appeal is that it promises zero-fee USDT transactions, a feat that has never been achieved before. Currently, one of the most optimal routes for saving money on stablecoin transactions is through the Tron network. Tron processed over $26.4 billion in daily USDT volume, making stablecoin transactions one of the primary sources of its fees earned. Stablecoins also make up a large portion of all on-chain volume.

With the introduction of Plasma, no chain can compete in terms of low-cost stablecoin transactions. Allegedly, we’re invested.

Relevance

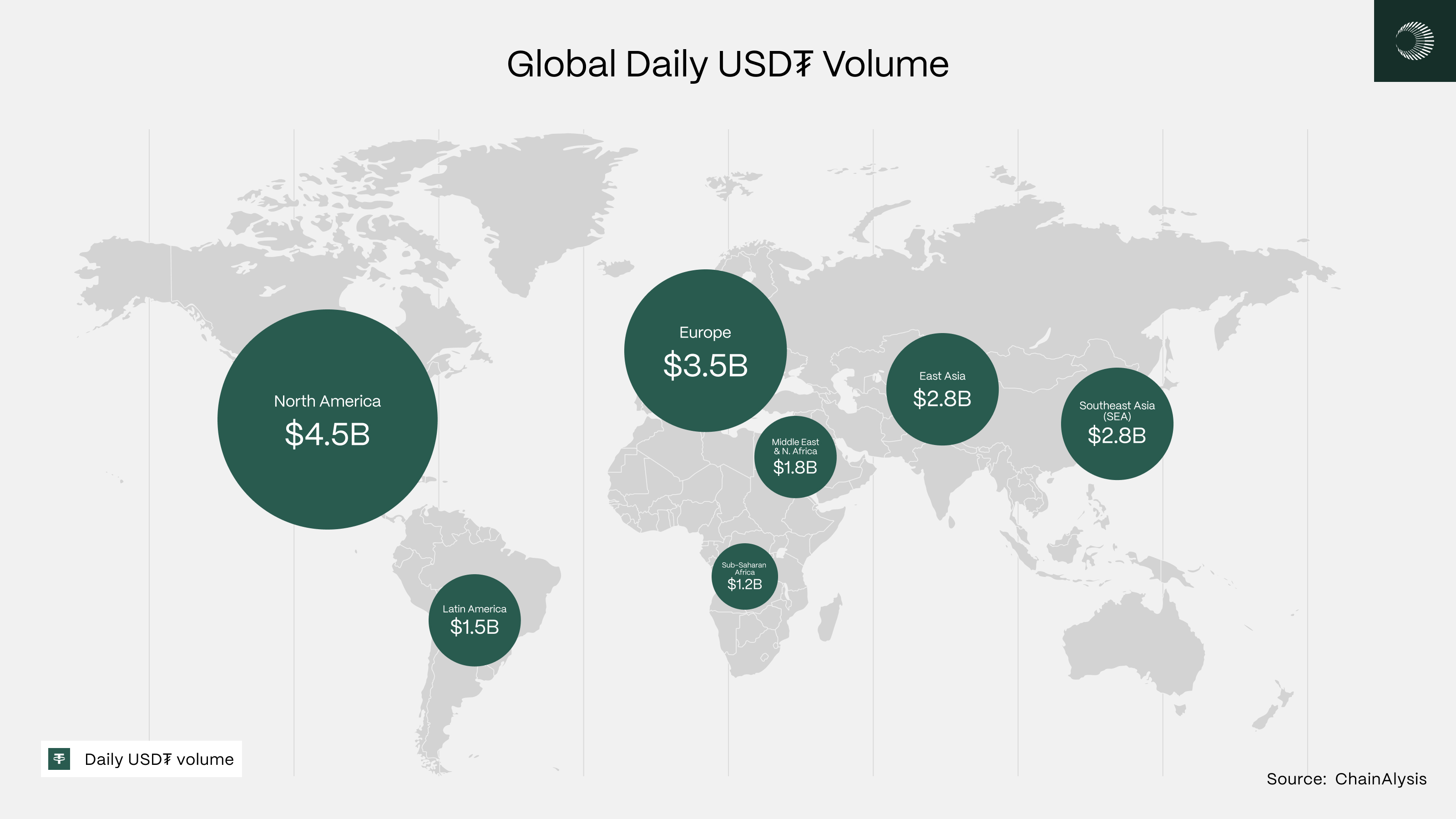

With the increasing adoption of cryptocurrency in the United States came the arrival of pro-stablecoin legislation through the GENIUS Act and other various policies. These policies helped create excitement for stablecoin technologies and encouraged many online businesses to begin adopting stablecoins as a payment method. Stablecoins also became more widely adopted in other nations around the world, as daily stablecoin volume has grown.

This led many retail and institutional investors to begin exploring ways to invest in stablecoin technologies to reap the benefits as the sector only continues to gain more adoption. As we saw from Circle’s IPO, the excitement is immense as $CRCL reached a peak of $23.5 billion FDV.

Yet, besides Circle, there were not many other ways to become exposed to the stablecoin sector, especially on-chain. Plasma’s presale announcement came at a great time, as it cemented itself as one of the only projects that would launch soon, which would bridge strong stablecoin fundamentals alongside adoption in the main commerce space.

Initiative

Besides “real-world” relevance, Plasma’s quick action allowed it to be the first mover among upcoming stablecoin chains. Stable, a stablecoin chain that also offers zero-fee USDT transactions, will launch at a later date. This is quite important as Stable also received support from Tether’s CEO, Paolo Ardoino, who has previously stayed neutral on chain bias until the appearance of Plasma and Stable. Plasma’s launch date will also beat out Arc and Tempo, upcoming stablecoin chains being created by financial giants Circle and Stripe.

Plasma also took the initiative by being the first project to be launched using Cobie’s new presale infrastructure, Sonar. Sonar’s innovative technology allows for a fresh way to raise money for upcoming projects and offers a fresh spin on ICOs.

Backing and Condition

Plasma also isn’t lacking in terms of backers. Plasma’s backing list consists of industry giants such as Bybit, Cobie, Peter Thiel, and Founder’s Fund. Many of these big-name investors are in earlier rounds, but these rounds come with harsher unlock conditions. Plasma’s tokenomics are great in the sense that the FDV in which it is raised is the exact same as Founder’s Fund and has the earliest unlock time. However, American citizens will suffer from an extra year of unlock time, which can be advantageous as it creates more demand later on.

Furthermore, due to the structure of the Plasma presale, it’s heavily in favor of users with high capital. This limits access of supply to those who do not believe heavily in the project or those who are in for a quick flip. The structure also allows for depositors to purchase the presale after gauging sentiment and how much of the presale has been bought out, providing some ease of mind.

Post-Presale Thoughts

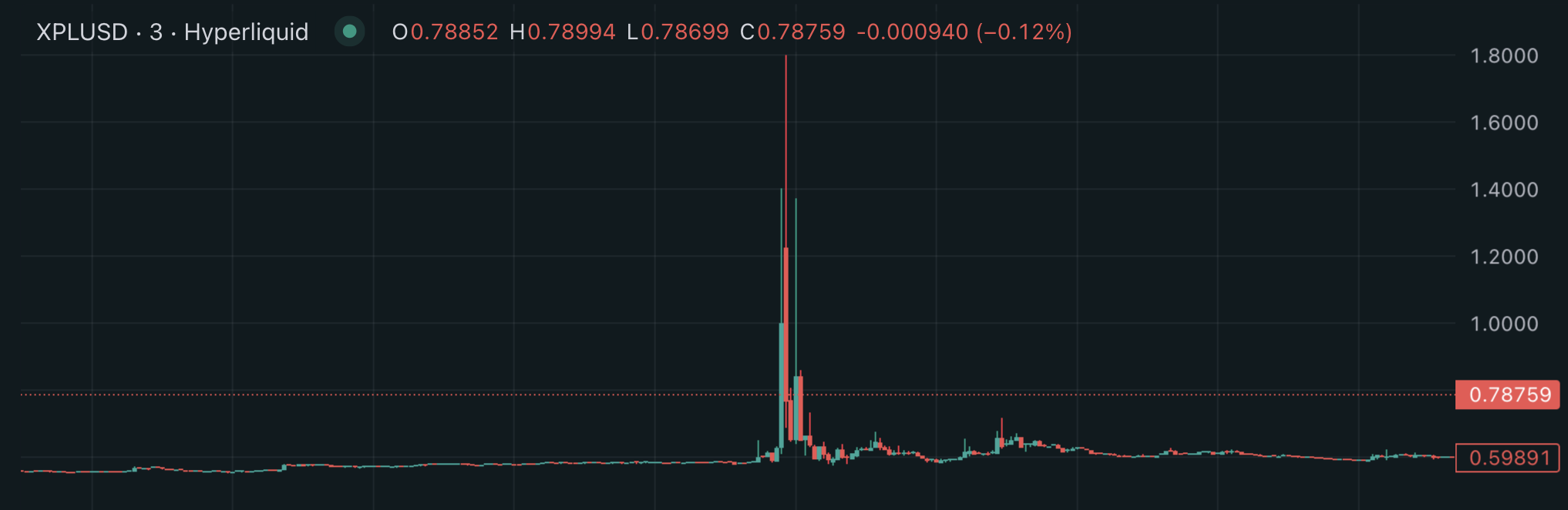

After Pump.fun’s ICO, we can observe that the post-presale but pre-launch time period has become a newly important part of a project’s performance. Due to the existence of high-volume pre-market trading, much of the initial trading volatility becomes absorbed by this pre-market volume.

However, a special incident occurred that completely shifted expectations for Plasma’s premarket. A user temporarily spiked the price of Plasma to $1.80 on Hyperliquid, causing a majority of people who were short to be liquidated. This has created a sense of fear for people who want to short or hedge their position and could end up making the premarket price inaccurate.

Conclusion

So what’s next for Plasma? For now, it's the next big thing, but in the future, we’re not too sure. Hopefully, it’s Trillions.