What is Flying Tulip?

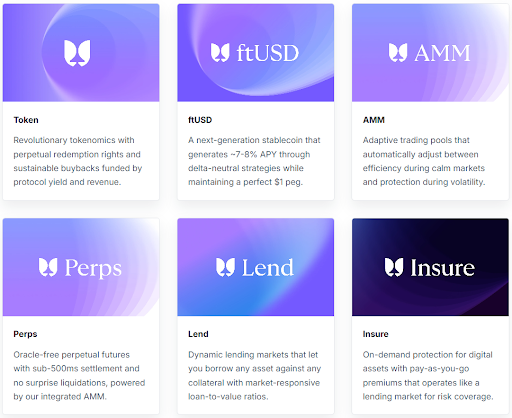

Flying Tulip is an all-in-one DeFi platform built around several complementary products:

ftUSD Stablecoin: a yield-bearing, delta-neutral stablecoin targeting 8–12% APY sourced from lending, borrowing, staking, and funding-rate strategies. Lending Protocol: redesigned risk models to reduce unnecessary liquidations. On-Demand Insurance: coverage for digital-asset exploits when you need it. Perpetuals DEX: aims to remove oracle reliance and lessen the knock-on effects of liquidations.

The product suite matches presently popular DeFi metas and layers in flywheel mechanics (e.g., buybacks) to reinforce demand. That said, the main draw is the project’s token sale structure, which is positioned as one of its primary differentiators.

Token Sale

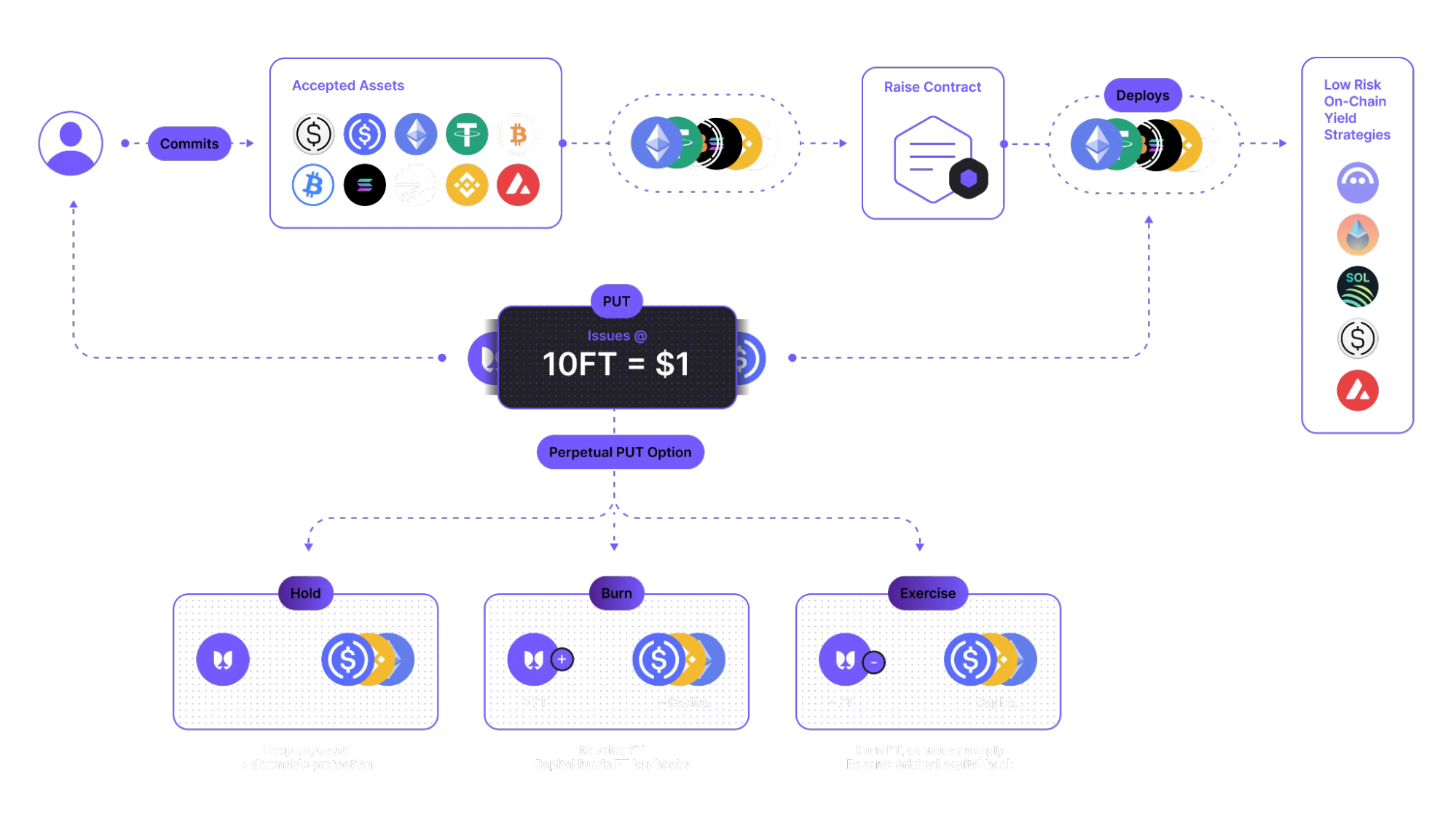

In a way, the Flying Tulip token sale will be an experiment, as there has never been such a large-scale raise with this form of fundraising. Rather than utilizing investor funds directly to fund the protocol, investor funds will instead be staked in various DeFi protocols like Aave, Lista, or Jupiter, and the yield will be used to fund project operations. Extra money earned from yield will be used for token buybacks that will be burnt. Furthermore, the team will not be allocated any supply immediately, as 100% of the supply will instead go to investors. The only way the team receives tokens is through the vesting of tokens that are bought back from protocol earnings. This incentivizes the team to build for the long term and inspires confidence in investors as the team is forced to be committed in order to profit.

The other unique part of the fundraiser is the downside protection offered by only staking the money raised. Since the money deposited into the presale will never be spent, the Flying Tulip team engineered a feature that protects investors from token downside. When an investor participates in the Flying Tulip presale, they are given an NFT that represents their token holdings. At any time with no expiration, they can redeem that NFT for FT tokens or they can redeem the NFT for a refund, which would burn any FT tokens associated with that investment. This lowers downside pressure for the coin because it establishes a “floor” at $1 billion FDV, and any refunds would not impact the price but instead lower the total supply.

The sale will be structured in four public stages. Stage 1 will be with ImpossibleFi and is meant for users or groups who can bring value to Flying Tulip through content and influence. Stage 2 will be through Coinlist and, like stage 1, will require KYC and will take a small fee from depositors. Stage 3 will be for supporters who will be selected based on preset criteria. Stage 4 is the “intent” round and will likely be where most people will enter the sale. This stage requires investors to fill out an interest form as well as pass an accredited investor quiz based on the Flying Tulip documentation. There is also a bonus public stage that will allow the purchase of whatever is left unbought from previous rounds. There will also be caps for each asset and chain, with the biggest pool being USDe on the Ethereum mainnet. Any overflow will be converted into room for USDC/USDT/ETH deposits on mainnet. The most likely outcome will be that stablecoin deposits will fill up quickly, while more risky assets like BNB or AVAX will take a long time to fill or will not fill completely.

Perpetual DEX Comparison

At its core, Flying Tulip is not a first-mover product. It’s entering a field with numerous competitors that have been released and established over the past few years; however, the mindshare and excitement for this area have only been growing more recently. The most notable projects in comparison by FDV are Hyperliquid ($40 billion), Aster ($12 billion), Avatis ($620 million), and Lighter (not yet launched but estimated at ~$2-3 billion). The market is humongous, and there is room for Flying Tulip to enter and for the perpetual dex meta to grow as a whole. Plus, Flying Tulip will not just be any other perpetual DEX; it aims to not rely on a typical oracle system and aims to create less market volatility due to liquidations. Both major issues that recently contributed to the downward spikes across all coins on November 11th, after ~$19 billion was liquidated across all exchanges, causing some coins to descend 80-90%.

Behind the Scenes

Besides the tech, Flying Tulip is by Andre Cronje himself, a legend in the DeFi space. He founded YearnFi and was CTO of Sonic, and was responsible for a major amount of its success. Andre spent almost a decade of hard work on Fantom/Sonic, and without him, the protocol would likely not be where it is today. Flying Tulip’s flywheel mechanics will likely result in large buybacks over time and will also likely yield high-interest DeFi farms through its various platforms.

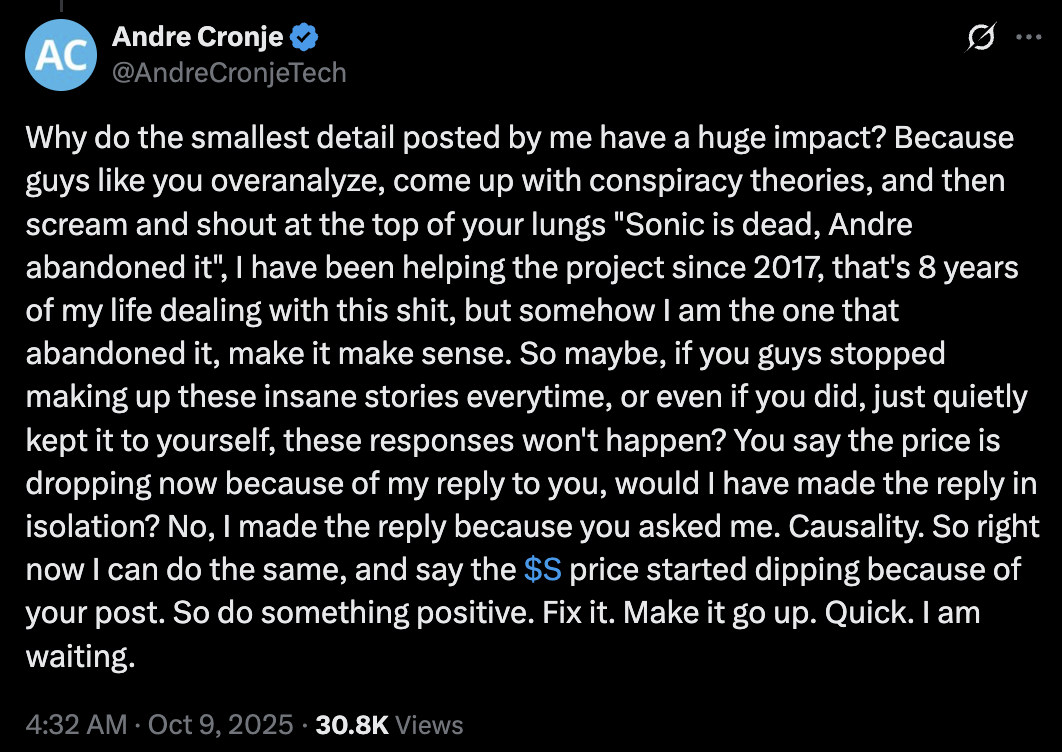

Looking into Andre Cronje himself, a tweet from less than a week ago deserves interest.

In this tweet, Andre defends himself from an X user who mentions how any of Andre’s actions can have drastic effects on a token’s price; in this case, specifically Sonic. Andre pushes back, arguing the market keeps misattributing causality: he only replied because he was asked, and critics then blame his reply for the price move. He reminds people he’s supported the project since 2017, rejects the ‘Sonic is dead/abandoned’ narrative, and calls out rumor-spinning that spooks holders.

This kind of blunt pushback demonstrates ownership: Andre actually cares about the projects he works on. Developers who have walked away from projects typically go silent. They stop engaging, stop clarifying, and certainly stop defending their work on social media, if even at all in the first place.

For Flying Tulip, this behavioral pattern carries weight. A founder willing to defend previous projects this forcefully, particularly when it invites criticism, is unlikely to treat Flying Tulip as short-term extraction.

Demonstrated Interest

As of right now, the interest in the Flying Tulip is immense, coming from both institutional and retail investors. The Flying Tulip team released a tweet announcing “significant institutional demand” and that any investor wanting to invest over $25 million to contact them directly. Additionally, ImpossibleFi, one of Flying Tulip’s partners for raising, announced that there’s been over $1 billion in demonstrated interest through their allocated raise, which only has room for $200 million in investments and requires KYC and a 1% fee. The $200 million raised in Flying Tulip’s private round is another source of proof for the massive interest in the platform and its token.

Concerns

As always, there are factors that can limit Flying Tulip’s upward mobility. One potential issue is the availability of 100% of the supply, which will be initially worth $1 billion. As the price moves up, the presence of such a large amount of potential sell pressure can pose as a massive obstacle in upwards movement. Another concern will be the lack of major exchange listings. As of right now, the only exchange that the Flying Tulip has planned will be their own exchange through their platform. This can limit the number of potential buyers, as potential investors would have to deposit money on the platform just to be able to purchase the token. But at the same time, this could be a good thing as it ensures a majority of the $FT trading volume to occur on the platform, which will earn more fees that can be contributed towards buybacks.